What to Know When Selling Your Home As-Is

Selling your home as-is may be the best option if you don’t plan to make repairs. Consider these things when listing your home as-is.

Selling your home as-is may be the best option if you don’t plan to make repairs. Consider these things when listing your home as-is.

House tours give buyers a good idea of which features they do and do not want in a home. Learn which features to look out for and which ones signal issues.

Cities and suburbs each have their own lists of pros and cons. Let’s take a closer look at moving trends to help you decide on your next big move.

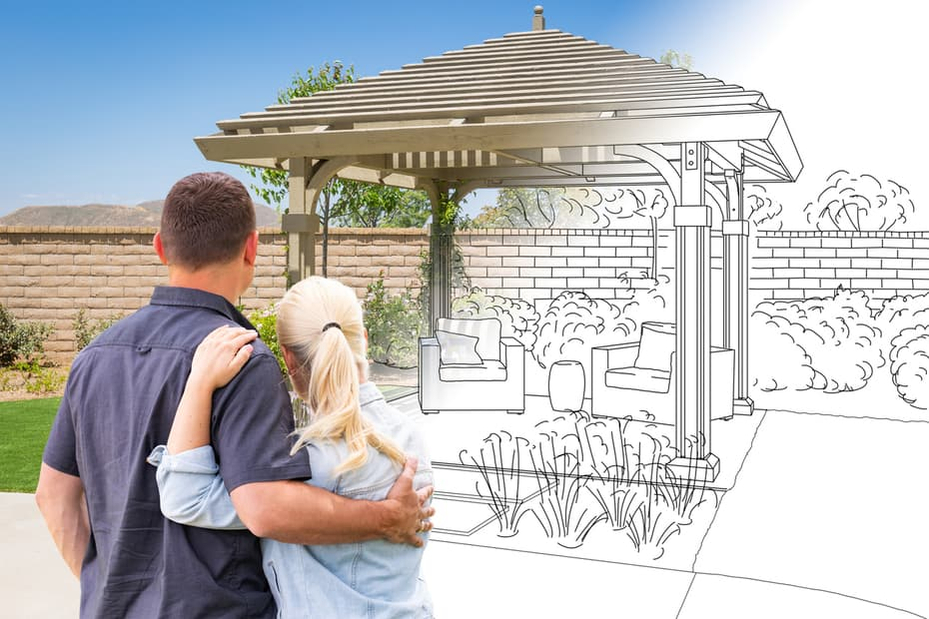

Adding outdoor features to your home can boost curb appeal and increase a home's value. Learn the simple ways you can enhance your outdoor space.

Spring cleaning is important, especially if you suffer from allergies. Follow this list of cleaning steps to keep your home spotless this spring season.

Buying or selling a home comes with certain tax advantages, do you know where to start? Learn how a recent home purchase or sale can affect your taxes.

Read our blog to learn the difference between pre-approval and pre-qualification and how they can impact your home buying transaction.

If, like most people, you plan on purchasing a home through a lender and not with cash, then you’ll want a good credit score. Why? Well, the higher your credit score, the more loan choices you’ll have and the lower your rates will be. Read on to learn more about credit scores and they can impact your home buying potential.

The last remaining months of 2021 saw a decline in home sales, however, this is not the case for the beginning of 2022. According to the National Association of Realtors®, existing-home sales saw a surge in January of 6.7%, a decrease of 2.3% from the amount of homes sold in January 2021.

Many home buyers panic when thinking about a down payment. Here is everything you need to know regarding down payments so you can prepare.

According to the FBI, there were 522,426 reported burglaries in 2020 alone. Even though COVID-19 drastically reduced those numbers from previous years, it’s still important to be prepared to avoid becoming part of the statistics. Here are some home security tips to keep your property safe from unexpected intruders.

Closing costs make up 3 to 5 percent of the home loan and include different fees and expenses you pay when you close on your house, in addition to the down payment. Depending on the size of your loan, it can be a large chunk of money, so it’s important to account for these costs ahead of time.