Real Estate News January Sees Existing-Home Sales Surge for 2022

Let’s Break Down What Happened in January 2022

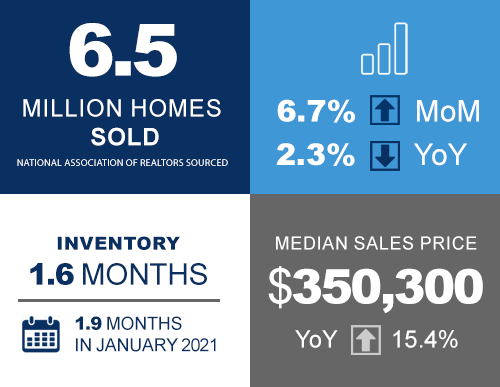

The last remaining months of 2021 saw a decline in home sales, however, this is not the case for the beginning of 2022. According to the National Association of Realtors®, existing-home sales saw a surge in January of 6.7%, a decrease of 2.3% from the amount of homes sold in January 2021. This includes single-family homes, townhomes, and condominiums, leading to a total of 6.5 million homes sold in January. Economists gathered that the sudden surge was due to buyers motivated by low interest rates and investors submitting all-cash offers.

What About Inventory?

Even though home sales surged, inventory was at an all-time low. January 2022 amounted to 860,000 units, which was down 16.5% from January 2021. Unsold inventory sat for an average of 1.6 months, a decrease from 1.9 months in January 2021. With very low inventory, buyers flocked to homes priced below $500,000. The median existing-home price in January was $350,300, an increase of 15.4% from January 2021. Homes priced above $500,000 experienced longer listing periods.

On average, properties remained on the market for only 19 days, a slight decrease from 21 days in January 2021. Seventy-nine percent of homes sold in January 2022 were on the market for less than a month. According to economists, more supply is needed at the lower-end of the market to achieve a more equitable distribution of housing wealth.

Who was Primarily Buying?

First-time home buyers were responsible for 27% of sales in January, down from 33% in January 2021. Individual investors and second-home buyers were responsible for 22% of sales, up from 15% in January 2021; and all-cash buyers accounted for 27% of sales, up from 19% in January 2021. Foreclosures and short sales represented less than 1% of sales, equal to that of January 2021. As the real estate market progresses, economists anticipate that the increase in mortgage rates will become problematic for certain buyers. Those who barely qualified for a mortgage when interest rates were low will be unable to afford a mortgage, and consumers in expensive markets will pay an additional $500 to $1,000 in monthly payments. According to Freddie Mac, the average interest rate for a 30-year, conventional, fixed-rate mortgage was 3.45% in January; the average interest rate in 2021 was 2.96%.

How Did this Affect Your Region?

Each region of the United States experienced the following increases for existing-home sales:

- Northeast: 6.8%, with a median price of $382,800.

- Midwest: 4.1%, with a median price of $245,900.

- South: 9.3%, with a median price of $312,400.

- West: 4.1%, with a median price of $505,800.

Of all the regions, the South witnessed the highest pace of appreciation for the fifth straight month.

The real estate market is experiencing the most fluctuation in decades. Don’t navigate these uncertain times on your own. HomeHunt is ready to help home buyers and sellers accomplish their goals with professional agents and lenders standing by. Let’s get started!